August 24 was a day of celebration for many federal student loan borrowers who earn less than $125,000. Learning about the $10,000 debt cancellation and $20,000 for Pell Grant recipients must have seemed like winning the lottery. According to the Department of Education, approximately 20 million Americans will have their student loans completely eliminated.

This debt forgiveness, like all other federal mandates, will have other impacts as well.

Build wealth more easily - Debt elimination, no matter what kind, can be helpful in the pursuit of building wealth. A $10,000 or $20,000 reduction in debt or liabilities will automatically increase wealth by those same amounts, all things being equal. Remember net worth equals assets (what you own) minus liabilities (what you owe).

Decrease stress – When the load of a financial challenge is lightened, you can’t help but feel a sense of relief while also becoming less anxious about the situation.

Reduce monthly payments - A lower student loan principal balance should equate to lower monthly payments after the payment pause is lifted on January 1, 2023.

Improve your credit score – Student loans are considered installment debt like mortgages or auto loans. FICO scores consist of payment history (35%), debt (30%), length of credit history (15%), new credit (10%), and types of credit (10%). Debt reduction may produce an increase in your score; however, it might decrease your score temporarily. For example, the 20 million Americans whose loan balances will be eliminated altogether might see a slight decrease in their scores if student loans are the only installment loan on their credit profile.

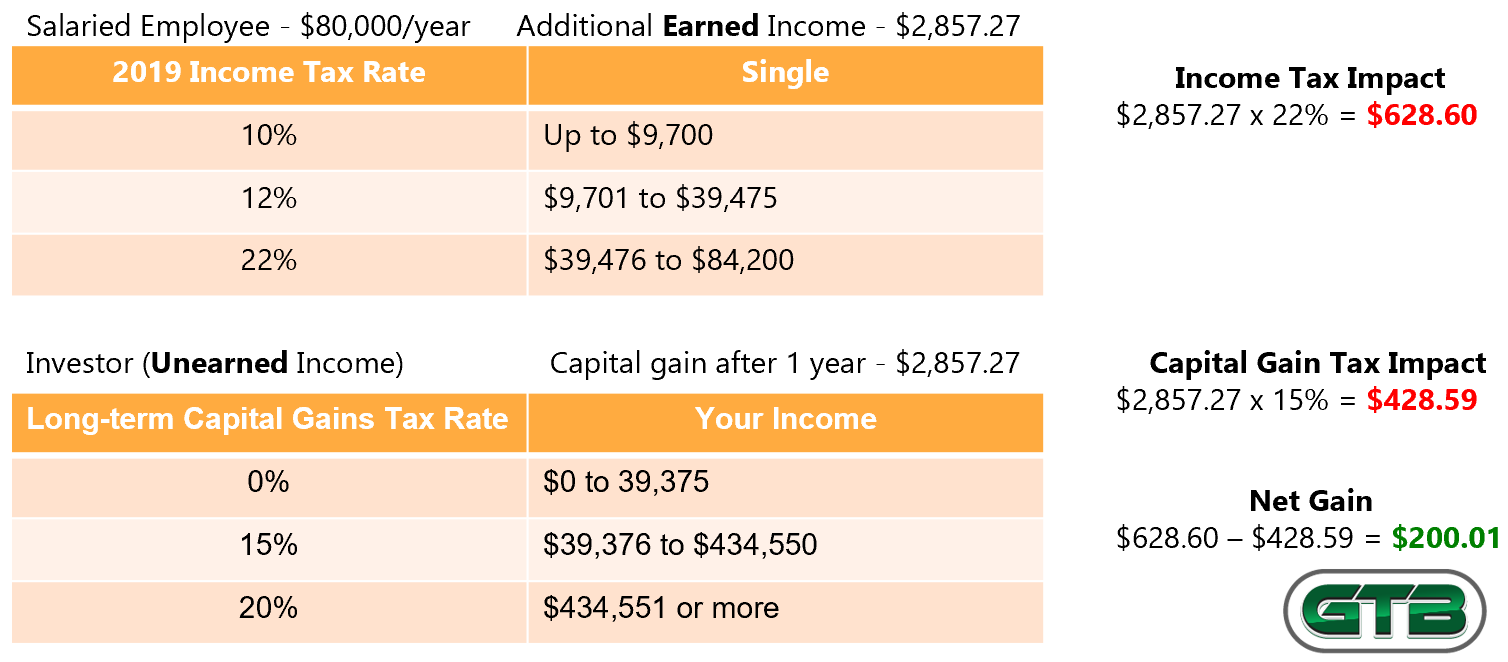

Avoid taxes on loan forgiveness – When the American Rescue Plan Act was passed in 2021, all federal student loan forgiveness became exempt from taxation through the end of 2025. Usually, forgiven debt over $600 is considered taxable income. More than likely, the 13 states that could charge income taxes on this forgiven debt will pass legislation to help borrowers avoid it. The states are Arkansas, Hawaii, Idaho, Kentucky, Massachusetts, Mississippi, New York, Pennsylvania, South Carolina, Virginia, West Virginia, and Wisconsin.

Promote a false sense of financial success – Although a debt may be forgiven, your individual responsibility for proper money management remains the same. The day-to-day financial behaviors you exhibit will have more of a long-term impact than a one-time debt cancellation.

Think about the debt cancellation from a different perspective. From this day forward, what financial behaviors would best serve your future if you won $10,000 or $20,000 tax-free? In whatever way you answer that question, before taking action, remember to count your money then give every dollar you earn instructions so it will behave.