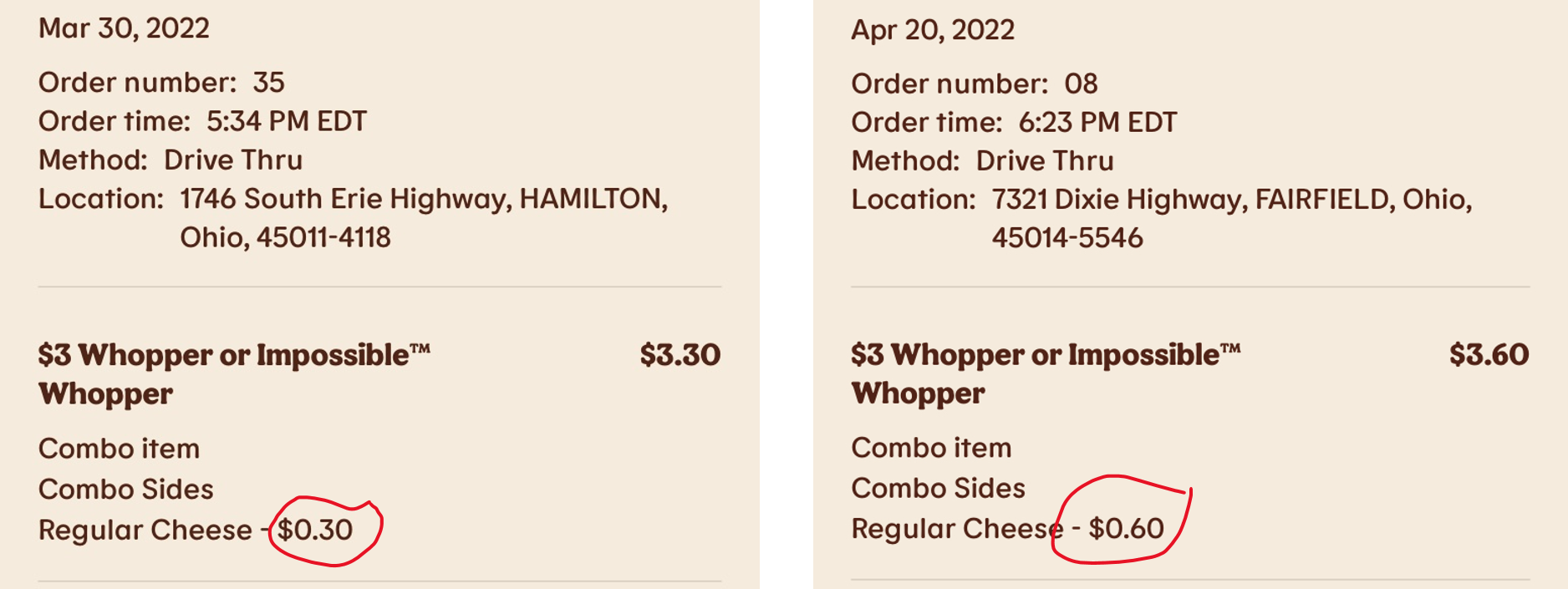

About once a month, Al Riddick treats himself to a Burger King Impossible Whopper. Recently, he noticed the fee for adding cheese had increased by $.30 within three weeks. Thirty cents does not seem like much, but when you consider that there are approximately 7,257 Burger King restaurants in the United States, it’s HUGE. A quick Google search uncovered there are 28 Impossible Whopper’s sold each day per restaurant, on average. That’s roughly 74 million Impossible Whoppers within a year. Instead of cutting the cheese (pun intended), let’s calculate how much cheddar is being generated.

In a year’s time, the thirty cent price increase will add over $22 million in sales. If you don’t think $.30 is a lot of money, think again. This number represents only Impossible Whoppers. Who knows how many people add cheese to the regular Whopper.

When thinking about your personal spending habits, $10 here or $20 there can easily add up to thousands before you know it. Although the increase in cheese prices is alarming, the cool part is that you, as the consumer, have the power to make different choices which can produce positive outcomes.

Let’s say Al chose not to add cheese on his Impossible Whopper and used a 10 cent slice from home. That would save $.50. He has a tough choice to make. Pay a 100% price increase or save over 83% ($.50 difference in cost divided by $.60 Burger King cheese price x 100) by adding cheese at home. You might think this example is over the top; however, when you apply the same logic to higher value purchases (cable, cell phones, clothes, shoes, flights, rental car upgrades), it can save you tens of thousands over your lifetime. Al could simply stop eating Impossible Whoppers, but that would ruin the treat. How many people do you know who are willing to give up things they enjoy? The goal is to enjoy life in moderation living below your means, not in misery.