On January 25, my dad, Alfred D. Riddick, Sr., passed away. Like most families, we were grieving—emotionally, spiritually, and physically. What we were not doing was scrambling for money or information. And that mattered more than I can fully explain.

The total cost of my dad’s funeral and repast exceeded $15,000. Because my parents had been intentional and responsible with their finances over the last 15 years of his life, there was no GoFundMe page, no urgent calls for help, and no financial panic. Every expense related to the funeral was paid within 24 hours.

Just as important, my mom didn’t have to carry unnecessary stress. All the key documents—insurance policies, account information, and clear instructions—were organized and stored in a safe deposit box. Once we received notarized copies of the death certificate, my role was straightforward: contact the appropriate companies and begin the claims process. No guessing. No digging. No confusion.

But here’s the part many families overlook.

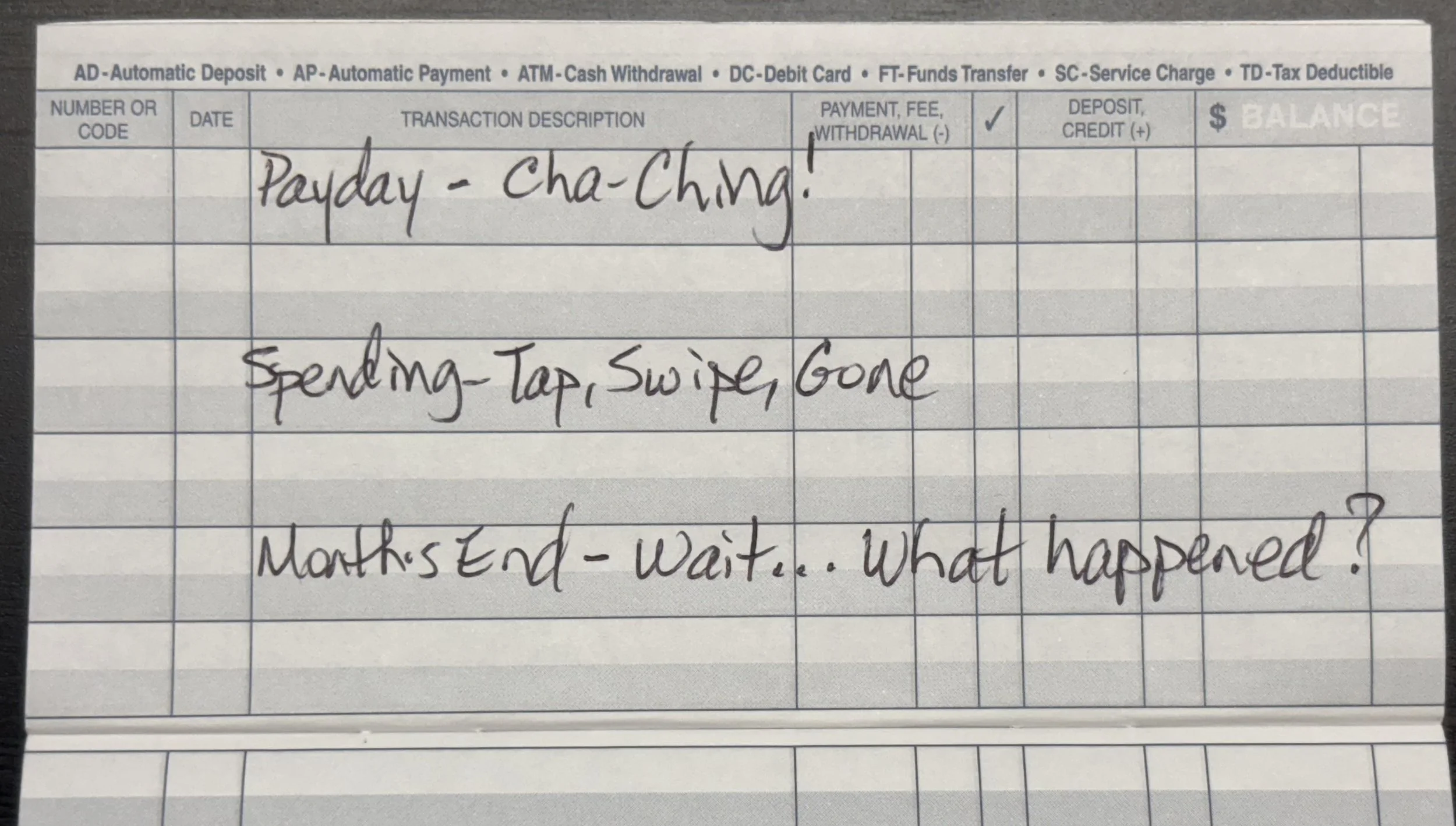

When a spouse passes away, the household income often changes immediately.

Because my mom is the surviving spouse, she will now receive my dad’s Social Security benefit since it was the larger of the two. Her Social Security check will stop. In addition, the retirement check my dad received from the State of North Carolina will also stop. Practically speaking, my mother will now live on roughly 50% of their previous household income.

That is a significant financial shift.

This is why it makes sense to enter your golden years with as little debt as possible—no mortgage payment, no consumer debt, no unnecessary financial obligations. When one spouse transitions, the emotional loss is profound. The financial impact is real. The last thing a surviving spouse needs is the pressure of fixed expenses built on a two-income retirement.

Preparing financially for your transition isn’t morbid—it’s an act of love.

The benefits of preparing in advance include:

Reducing emotional and financial stress for your loved ones

Ensuring funeral expenses can be handled quickly without debt or fundraising

Providing clear instructions and access to important documents

Minimizing confusion and delays during an already difficult time

Structuring retirement so the surviving spouse can live with stability and dignity

My dad gave us many gifts. One of the last was peace of mind.

If you haven’t prepared yet, let this be your reminder: planning ahead isn’t about fear—it’s about love, leadership, and protecting the people who will one day have to carry on without you.

One of the things my dad talked about during his final year was making it to 81. He would joke that the Bible promised “three score and ten” (70 years), so the extra 11 were his bonus years.

In honor of his 81 years and the legacy he leaves behind, I’m opening 81 spots in my online financial wellness course for $8.10. If you’re ready to give your money clearer direction and build something that lasts, I invite you to join us.

Use code bonus11years to enroll. Here’s the link: Game On - A Financial Fitness Experience

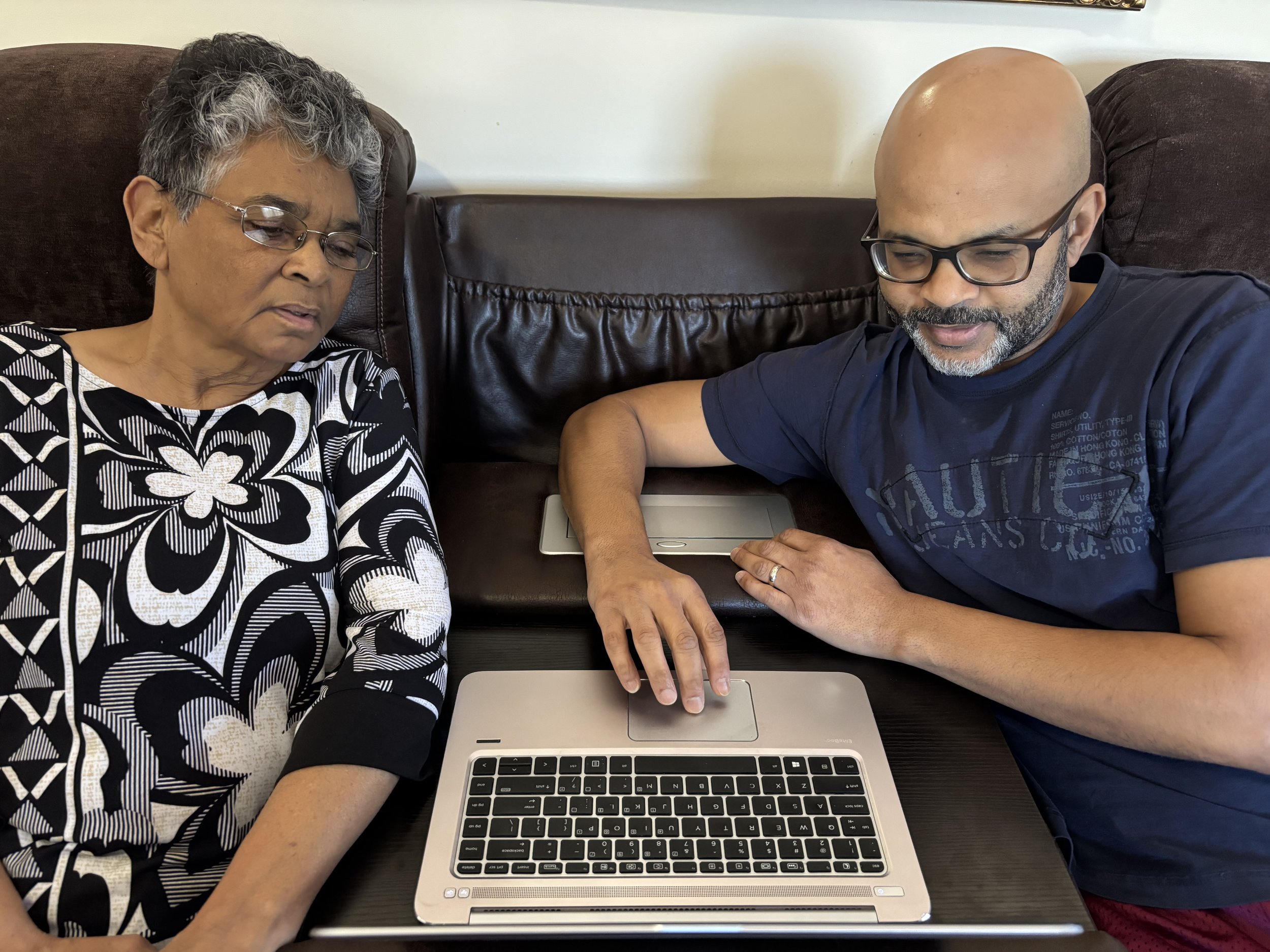

Me and mom reviewing her new budget effective February 1, 2026.